Most people do not believe that there is free money for college. However, the federal government provides students with this financial support in the form of grants such as the Pell Grant.

With this grant, one does not have to pay back the cash, unlike private student loans. For a Pell Grant, there is no income limit, but one must prove financial need.

This article provides in-depth details you need to know about a Pell Grant, its eligibility, and how to apply for one.

What is a Pell Grant?

The Pell Grant is among the largest grant program supporting undergraduate students that the U.S Department of Education offers.

Established in 1972 by Congress, this program encourages needy students from low-income backgrounds to attend college. The federal government of the United States offers the subsidy to students to pay for college education.

To apply for the Pell Grant, interested persons should complete the (FAFSA) Free Application for Federal Student Aid.

However, the grant comes with some strings attached. It is only limited to needy students, who have not had their first bachelor’s degree, or those enrolled in post-baccalaureate programs. If one qualifies, it can be of significant help in fulfilling your college dreams.

Students should view the Pell Grant as a source of aid since one does not have to repay the amount they are eligible to.

Other forms of aid include the federal work-study program that requires one to work for an hourly wage and a student loan that needs to be repaid.

The Pell Grant Eligibility

To qualify for any federal financial support, whether a federal student loan or a Pell Grant, fill out a FAFSA first. The FAFSA also helps one see the amount of funding they are eligible for. Apart from financial considerations and income amounts, there are several basic requirements for a Pell Grant.

One has to fit certain eligibility criteria to qualify for a Pell Grant, including:

- Have citizenship or legal noncitizen. One has to be a United States citizen to receive federal aid. However, if you are a green card holder with an active social security number, the federal government considers you an eligible non-citizen.

- Be a high school diploma holder or its equivalent. To be eligible for a Pell Grant, you must have a high school diploma that can help you join a university or a community college.

- Enroll as an undergraduate student in an eligible degree-granting program. One has to be in school to receive Pell Grant or any other financial aid. The federal government offers financial aid to encourage graduation. However, one must fill out their FAFSA before joining the school. Accredited universities and community colleges are eligible.

- Not be a degree holder. Pell Grant is strictly available for undergraduates only. If you are almost done with your postgraduate degree, including a master’s or doctorate, you will not receive a Pell Grant. Remember, federal aid’s primary aim is to help needy students complete college and have a degree.

- Not be incarcerated or convicted for certain crimes. Students serving time for crimes such as sexual harassment are not eligible for the Pell Grant. However, if one is in an experimental Second-Chance program, which partners with over 130 colleges, they may be eligible for the grant. Immediately an individual is released, their federal student aid eligibility limits are removed.

- The federal government allocates some Pell Grant funds to students in the post-baccalaureate teaching certification program

- If you are a male applicant of between 18 and 22 years of age, you should not be enrolled with any Selective Service

- Not be a federal student loan defaulter.

One may lose their Pell Grant eligibility if they withdraw from different courses or do not maintain their enrollment status. Also, if one fails to make academic progress that includes the individual institution’s GPA requirements, they risk losing eligibility.

The federal government provides Pell Grants based on their funding, which changes every year. They set maximum amounts every year and disburse the funds through your institution’s financial aid office.

For 2021-2022 the maximum Pell Grant is $6,495.

The federal government bases your Pell Grant amount partially on your financial need or that of your family. Besides, the amount your school charges, and whether you want to attend full part-time, determines the amount you receive.

The government uses a special formula to determine the applicant’s financial need and figure out your family’s estimated contribution. The formula begins with the percentage of your family’s gross income, minus living expenses, as well as taxes.

Some of your assets may be included, leaving others as protection allowance. Also, the formula also considers the size of your family and the number of kids attending college.

The federal government provides students with funding twice every year directly through the institution.

Full-time students get more funding compared to part-time students. Unfortunately, if one drops below half-time status, they increase their chances of reimbursing their gifted funds.

To continue receiving the Pell Grant funding, one has to resubmit their FAFSA every year and maintain satisfactory academic progress.

You can enjoy the Pell Grant funds for a maximum of 12 semesters. However, one can use additional grants to help cover other financial gasps and the cost of college.

There are several options available; for instance, if your family income is high and disqualifies you from the Pell Grant, you can file as an independent student other than a dependent one.

If you are above the age of 24 years, married, living on your own, and your parents do not claim you on their taxes, apply for the FAFSA as an independent student.

The federal government does not base all financial aid on income. You can still be eligible to take federal student loans and apply for scholarships if your income or that of your family is too high for need-based aid.

Based on your specific situation, your institutions’ financial aid office can also help you significantly to determine the federal aid and options available. Fill out FAFSA every year regardless of your family’s financial status to see if you qualify for federal student financial support.

Pell Grant Lifetime Limit

As mentioned earlier, students can enjoy Pell Grants for 12 semesters of full-time schooling, which is equivalent to six years.

Besides, it is possible to hit Pell Grant lifetime sooner, for example, if you attend summer classes. If you are not a full-time student, it can take longer than six years to get to the lifetime limit.

The amount that an applicant is eligible to depend on several factors, including your financial need, part-time or full-time status, cost of attendance, and attendance plan, whether a full academic year or less.

Click here to check the 2021-2022 award year.

How Pell Grant works

The federal government base the lifetime maximum depending on years, not dollars. For full-time students, the amount they receive represents 100 percent of that year’s Pell Grant eligibility regardless of the dollar amount. Every year is worth 100 percent with 600 percent lifetime for every eligible student.

One can use more of the 100 percent Pell Grant or less in a year. However, once the 600 percent is depleted, one cannot receive a Pell Grant at any educational institution. Unfortunately, there is no appeal process.

Even after completing your degree without exhausting the 600 percent, one can still be eligible for Pell Grant funds if interested in adding an undergraduate degree.

The percentage that one receives counts towards their (LEU) Lifetime Eligibility Used. To keep track of your Pell LEU, you only have to log onto (NSLDS) National Students Loan Data System. Also, the system notifies eligible Pell Grant students when they are getting close to their lifetime maximum.

The federal government imposed the percentage regulation to encourage graduation and minimize its federal expenditures.

If you attend school full-time, each year, you can hit your lifetime limit within six years. Also, factors such as your enrollment status can help hit your Pell Grant lifetime limit in more than six years or sooner than that.

How do I apply for a Pell Grant?

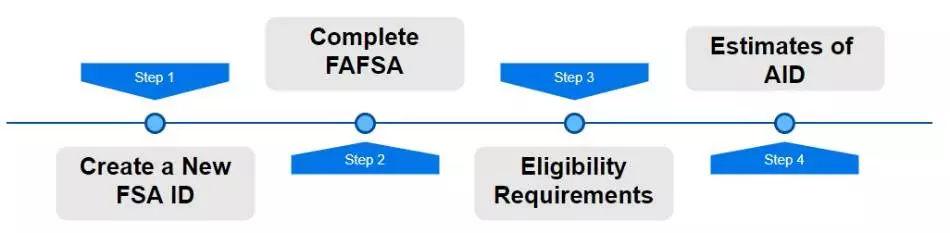

As mentioned earlier, one has to fill out the (FAFSA) Free Application for Federal Student Aid for the federal government to consider you for a Pell Grant.

Therefore, the first step to take is to create an FSA ID. The ID works similarly to other sites. To log into the FAFSA website, one requires a username and password. Visit the FAFSA website to set up your FSA ID and click the “Start a New FAFSA” option. Click the “Enter your FSA ID” option on the next page. That option provides a link to create an FSA ID.

After creating the FSA ID, log in and click on the “Start a New FAFSA” option to begin a new application. However, if you had filled the FAFSA before, log in to update your previous information.

One must list the schools they want the federal government to send their financial aid to. Ensure to look up each school code, but the FAFSA can also be of help.

The form allows one to list up to 10 schools, though one can add more later. Some cases demand one to list their schools in a particular order. It may request one, to begin with, the state schools first to receive special kinds of financial aid.

Ensure to fill in dependency questions. One has to go through the FAFSA dependency questions to determine their dependency status officially. In this section, one has to fill in their age, marital status, and children.

Fill in your personal information and that of your parents. Upgrading your biographical information is essential at this step. Your parent’s information, such as their driver’s license numbers and Social Security numbers, may be needed.

FAFSA may request your financial information as well as that of your parents. The system may also ask about any assets you own.

Ensure to fill in this information carefully and to the best of your ability. Besides bringing in information from the IRS, the FAFSA can prompt using the Data Retrieval Tool. It is unnecessary to use the tool, but it can come in handy in making the process easier.

After filling in all the information, it is time to submit your application. To ensure it goes faster, use your FSA ID. Remember to click “Submit” and ensure to wait for the confirmation page on-screen or your email. It is vital to print the confirmation page since it has extra information.

Conclusion

Your college dream can come true if you apply for federal student aid such as the Pell Grant. It is not a taxable income, and one does not have to worry about repaying the gifted funds.

However, it is essential to remember that withdrawing from courses and changing your enrollment status after the federal government awards you the Pell Grant risks your eligibility and may have tax implications.

Please get to know very well the type of grant that you are looking for and review the terms and conditions before applying.

Financial Advice Disclaimer

This post is for general information purposes and does NOT intend to provide any financial advice or recommendations for any individual, please follow the proper regulatory requirements and seek independent financial advice before applying to any federal loan.