The FAFSA is not a loan. It is an application form named Free Application for Federal Student Aid.

This form is used primarily to apply for grants, work-study, and loans in the U.S.

The FAFSA is divided into seven steps, steps 1, 2, 3, 5, and 6 are for the student, step 4 is for the parent, and step 7 is for the student and the parent.

All questions in the FAFSA are mainly to calculate the Expected Family Contribution (EFC).

Depending on your family’s financial strength which is measured through the EFC, will be the eligibility criteria for federal student aid.

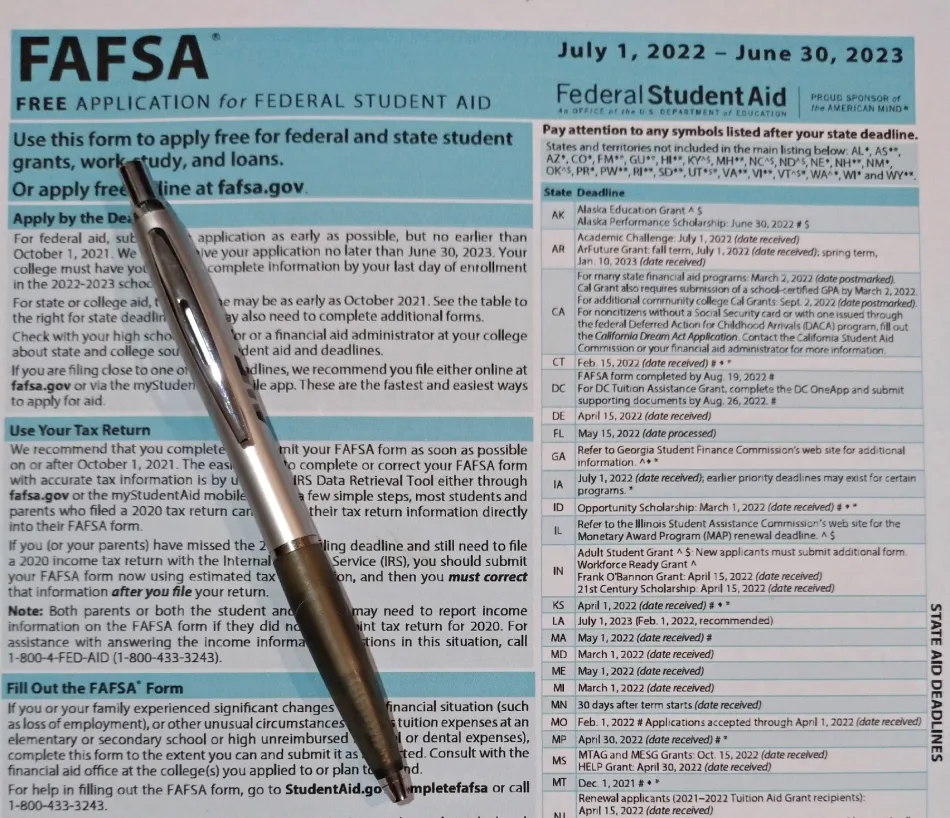

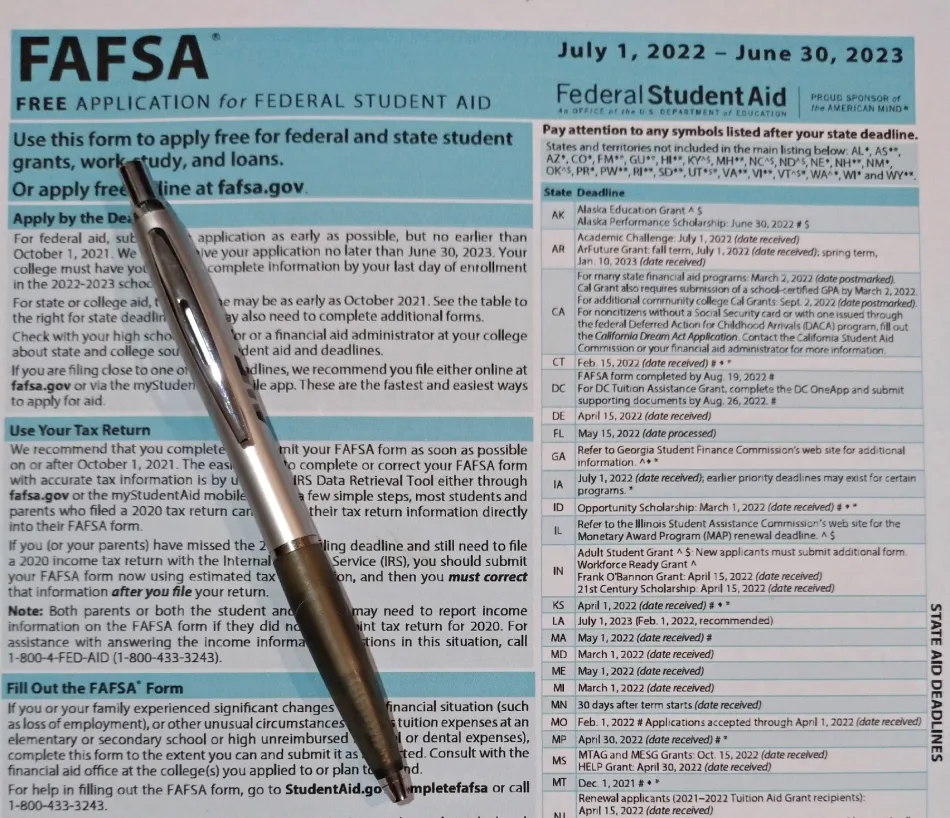

Download the FAFSA 2022-2023.

If you need any help filling out the FAFSA form you can go straight to their website at StudentAid.gov/completefafsa or call them directly at 1-800-433-3243.

One of the additional tools at Federal Student Aid is the FAFSA IRS data retrieval tool.

You can use the FASA IRS data retrieval tool also called (IRS DRT) to transfer your federal tax returns information electronically into the FAFSA form. Follow the steps here.

When does FAFSA Close?

Remember that in order to apply for a Pell Grant you must complete the FAFSA form, however, that’s not all, as you know Federal Student Aid is limited, therefore, there are some deadlines you must meet.

There are three primarily deadlines that you must consider:

- Federal Deadlines

- College Deadlines

- State Deadlines

For Federal Deadlines of the 2021-2022 academic year, you must complete and submit your FAFSA form no later than 11:59 p.m. Central time (CT) on June 30, 2021.

For Federal Deadlines of the 2022-2023 academic year, you must complete and submit your FAFSA form no later than 11:59 p.m. Central time (CT) on June 30, 2022.

For College Deadlines, you must check with the college of your interest as each college has individual deadlines.

For State Deadlines, check out the FAFSA deadlines by state for 2022–2023.

What happens after you submitted the FAFSA

Once your FAFSA has been submitted these three things will happen:

- Depending on what type of submission you did is the time the U.S. Department of Education will process your application.

- If you submitted your FAFSA through the web the U.S ED will take 3-5 days approx to process your application;

- If you submitted a paper FAFSA then U.S ED will take 7-10 days approx to process your application

- You will receive a copy of your Student Aid Report (SAR) after your application is processed, this report summarizes all the information you provided on your FAFSA.

- Here is where you get the chance to review that all of your information is correct before proceeding

- Your SAR will be sent to the colleges you entered in your FAFSA, in this case, each college will use your SAR information to determine your student aid eligibility criteria.

- NOTE: Each college is responsible to create your award package, however, sometimes your SAR information is not sufficient, it is recommended that you contact the financial aid office of the college you are interested to attend.

FAFSA vs Pell Grant

As we discussed in the previous section FAFSA is the application form for grants or federal student loans, therefore, you can use the FAFSA form to apply for the Pell Grant.

However, a Pell Grant is government money allocated to support undergraduate students in the U.S. that have proven financial needs.

The Pell Grant is NOT a loan and a good thing for you, this grant does not have to be repaid after the student graduates, except if you fall under certain circumstances. Check here the criteria of when you may need to repay a grant.

The maximum you can get from the Pell Grant in 2021-2022 is $6,495.

There are some basic requirements that you need to meet first in order to qualify for a Pell Grant

- Have citizenship or legal noncitizen

- Be a high school diploma holder or its equivalent.

- Enroll as an undergraduate student in an eligible degree-granting program.

- Not be a degree holder

- Not be incarcerated or convicted for certain crimes.

- and more…

and the difference is…

- The FAFSA is the form you will need to complete in order to get a Pell Grant or Student Loan.

- The Pell Grant is the student aid you will receive once your FAFSA application has been processed and approved.

You can apply for a Pell Grant every year, however, each time you will need to complete and submit a new FAFSA.

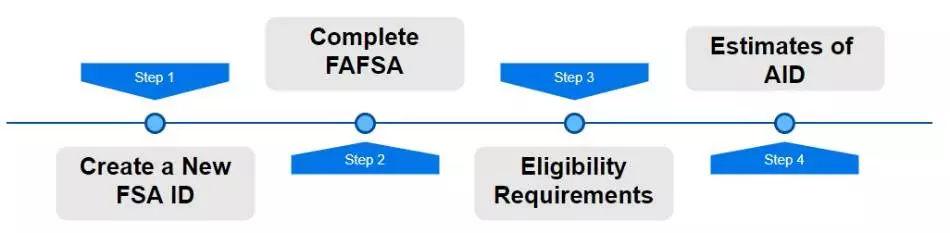

Pell Grant or Federal Student Loan process

Here are the general process steps in order to apply for any Federal student loan:

- Create a New FSA ID

- Complete the FAFSA

- Meet the Eligibility Requirements

- Check the estimates of aid.

Check out my post on Federal Student Loans where I describe this process in detail and give more information about the different student loans available that you can apply to.

Conclusion

Is the FAFSA a loan? The FAFSA is NOT a loan… is a form that you must complete and submit in order to get any grant or federal student loan.

Pell Grant is the actual form of student aid that you’ll receive once your FAFSA is processed and you qualified depending on the college you entered.

Take into consideration that all these processes take some time and you must do your due diligence as you are getting student aid, check all terms and conditions of any type of loan or grant that you get.

It is recommended that you fully immerse in the types of loans or grants before applying, also be aware of your own financial circumstances as some of these loans will introduce tax interest rates.

Financial Advice Disclaimer

This post is for general information purposes and does NOT intend to provide any financial advice or recommendations for any individual, please follow the proper regulatory requirements and seek independent financial advice before applying to any federal loan.