Looking and applying for Federal Student Loans can be daunting at first, however, in this post I’ll try to simplify the process and explain what are the available Federal Student Loans, their interest rates, some of the benefits, and how you may apply.

What is a Federal Student Loan?

A Federal Student Loan is money you borrow from the federal government as a student or parent to cover the cost of your education.

Any Federal Student Loan must be repaid back with interest.

There are multiple organizations that can provide you with student loans, for example, the federal government, banks, financial institutions, or other organizations. Make sure you understand the terms and conditions of your loan before you apply.

Types of Federal Student Loans?

There are four types of Federal Student Loans under the U.S Department of Education program:

- Direct Subsidized Loan

- Direct Unsubsidized Loan

- Direct PLUS Loan

- Direct Consolidation Loans

Direct Subsidized Loan

This type of loan is made specifically for undergraduate students who demonstrated financial need as determined by the federal regulations.

The amount you can borrow will be determined by your school, typically up to $5,500 per annum depending on your specific case, this figure is subject to change.

Check the annual and aggregate limit for this type of federal loan.

The interest rate is fixed for the life of the loan 2.75% for loans on or after July 1, 2020, and

before July 1, 2021.

Now, you may be asking.. who will pay the interest of this loan?, well, at the end of the day is going to be you, however, there a three scenarios where the U.S Department of Education will pay the interest:

- While you are in school at least half-time;

- During deferment (this is a period where loans are postponed)

- During the grace period (usually for the first six months after you leave school);

Check down below this post for the application process.

Direct Unsubsidized Loan

A federal student loan for undergraduate, graduate, or professional students, however, the eligibility of this loan is not focused on financial need.

Also, in this case, your school will determine how much you can borrow. Typically up to $20,500 per annum depending on your case. This figure is subject to change.

Check the annual and aggregate limit for this type of federal loan.

The interest rate is fixed for the entire life of the loan, however, there are two interest rate scenarios with this federal loan:

- 2.75% for undergraduate students

- 4.30% o graduate and professional students

With this federal loan, you are responsible for paying the interest at all times.

Check down below this post for the application process.

Direct PLUS Loan

This federal loan is made for graduate and professional students but also for parents of dependent students, however, eligibility is not based on financial need, but… it is an unsubsidized and credit-based loan. So if for any reason you have an adverse credit history, additional requirements may be needed to qualify.

There are two subcategories for this type of loan: Grad PLUS Loan and Parent PLUS Loan.

In both loan types, you must not have an adverse credit history or additional qualification requirements will be needed and you must meet the general eligibility requirements.

However, for Grad PLUS Loan you must be a graduate or professional student from an eligible school and for the Parent PLUS Loan, you must be the biological or adoptive parent of an undergraduate student from an eligible school.

Talk to your school in order to determine the amount you will be able to borrow.

A fixed interest rate of 5.30% for this type of federal loan on or after July 1, 2020, and

before July 1, 2021.

Check down below this post for the application process.

Direct Consolidation Loans

This federal loan allows you to combine multiple federal loans into one single loan with no additional cost for you, (run by the U.S Department of Education and NOT by private companies or other financial institutions, this process is free of charge), this is beneficial for you when you want a single monthly payment instead of multiple payments.

Some of the basic questions before consolidating:

- Do I have a Federal or Private Loan?

- Is the type of loan that I have eligible for consolidation?

- What are my current financial circumstances?

- Should I really consolidate my loans?

The answer to those questions will be specific to your financial situation at the time being and the type of federal or private loans you would like to consolidate, check here the eligible loans to consolidate.

Another thing you must consider when consolidating is the interest rate for this type of Federal Loan, in this case, it will be the weighted average of your total interest rates and it will be concentrated into one single interest rate.

So, when applying for a consolidation loan please consider that you may lose some of the benefits of the original loan agreements when it comes to repayments and flexibility, and there are no guarantees that the new interest rate will be better.

Please familiarize yourself with the specific type of loan you have and weigh the pros and cons before making any decision.

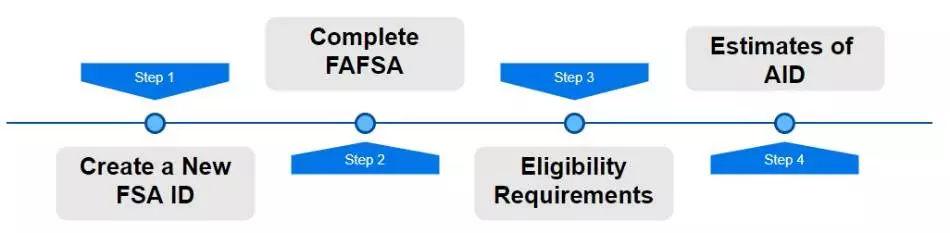

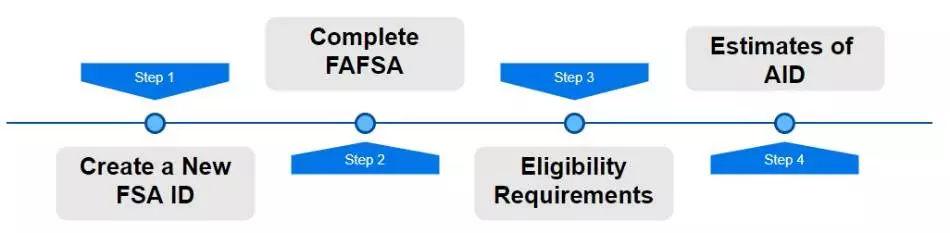

Federal Student Loan Application Process

Follow the next steps in order for you to apply for a Federal Student Loan:

- Create a new FSA ID: The FSA ID gives you access to the Federal Student Aid’s system, however, it is also intended to serve as your legal signature.

- Complete the (FAFSA): The Free Application for Federal Student Aid form is a pre-requisite in order to request financial aid.

- Check the eligibility requirements: as you know, to apply for federal aid you must meet certain requirements, are you a U.S citizen or not? what are your financial circumstances? are you in an eligible degree? and more, please check the requirements before applying for a federal loan.

- Check the estimates of aid: check this tool made by the U.S Education Department in order to estimate your eligibility for federal student aid.

In Conclusion

Whether you have a Federal Student Loan or looking to apply for one, you always need to familiarize yourself with the type of loan you are looking for, be aware of your financial situation, check the requirements before applying to any federal loan and the terms and conditions of your current and/or future loans.

In the case of consolidating your loan, there are four things that you must consider: in order to consolidate your federal loans you won’t need to pay for the consolidation process: is free, unless you use a private institution; make sure you have a fixed interest rate and not variable; if possible make sure your new interest rate is lower than your current and finally but not least check the terms and conditions for repayment periods, the idea is to help you pay is a shorter time not longer.

Financial Advice Disclaimer

This post is for general information purposes and does NOT intend to provide any financial advice or recommendations for any individual, please follow the proper regulatory requirements and seek independent financial advice before applying to any federal loan.